A&a Works for Beginners

Table of ContentsThe Facts About A&a Works RevealedThe Ultimate Guide To A&a WorksNot known Facts About A&a WorksAn Unbiased View of A&a WorksSome Known Details About A&a Works

Before applying for any financing, keep in mind that your credit rating plays a critical function in securing in the most affordable rate of interest price. If you have time, take into consideration taking actions to boost your score by paying down credit rating card bills and making all payments on time. Will you require to rent out a location to live somewhere else while the job is occurring?By doing this, the funding is a financial investment that might boost the home's value. You can certify with a deposit as reduced as 3 percent if you're a new purchaser getting a fixed-rate financing and you prepare to stay in the home. It might feature lower rate of interest and shorter payment terms than conventional enhancement loans.

Costs and shutting expenses might be greater than other types of home loan. Nonetheless, with Fannie Mae's Neighborhood Seconds program, you might have the ability to borrow up to 5 percent of your home's worth to help cover the deposit and closing prices - A&A Works. Caret Down In a competitive genuine estate market, a Fannie Mae HomeStyle Improvement loan might not be optimal if you're looking to safeguard a bargain fast

Indicators on A&a Works You Need To Know

FHA 203(k) loan a government-backed standard rehab car loan funds the home acquisition and its renovations. The Federal Housing Management insures this loan, and its goal is to produce more alternatives for house owners or buyers of homes that need recovery and repair.

You might be eligible for a larger tax reduction (the bigger financing combines renovation and home acquisition). Any kind of improvement is restricted to the FHA's listing of eligible projects.

The financing can not be utilized for a luxury/purely discretionary renovation, such as constructing a yard swimming pool or tennis court. The car loan is likewise only for key homes, not second homes or vacation houses. A home equity financing is a fixed-rate, lump-sum financing with month-to-month repayments that remain the very same for the funding term.

Rumored Buzz on A&a Works

Home equity loans included set rate of interest prices and payment quantities that continue to be the same for the life of the financing. With a HELOC, you can draw funds as you require and only pay passion on what you draw. You may have the ability to deduct the rate of interest if you detail on your income tax return.

You can't draw funds only as needed with home equity finances as you can with HELOCs. Qualifications may be much more strict: You need to have and preserve a specific quantity of home equity.

A cash-out refinance can have the dual advantage of letting you re-finance a higher-rate home mortgage to one with a lower price while drawing out cash to spruce up your residential property. A lower rate and a rise in home worth as a result of restorations are great long-lasting advantages.

Not known Factual Statements About A&a Works

You may be able to get a lower rate of interest price or transform your funding term. The cash-out is consisted of in the brand-new home mortgage, so there are no different settlements to make (A&A Works). A section of the cash-out passion might be tax-deductible. Caret Down You have to utilize your home as security. You have to contend the very least 20 percent equity in your house to be qualified.

Unlike a refi or home equity car loan, a personal funding is unprotected, so you don't have to use your home or any various other property as collateral. Car loan eligibility is based upon your credit history, revenue and monetary background. Consumers with "great" Your Domain Name FICO credit report of 740 and up obtain the ideal rate of interest rates on personal lendings, and some lenders expand personal car loans to consumers with credit rating as reduced as 580, though the rates on those tend to be a lot higher.

Personal lendings also give the borrower great deals of visit this site leeway regarding the kind of renovations that they can make. Lenders additionally have a great deal of freedom concerning the amount of passion they can bill you. Basically, if you're borrowing cash at a 25 percent rates of interest, you're going to pay even more than could be required to complete site web your project.

A&a Works - Questions

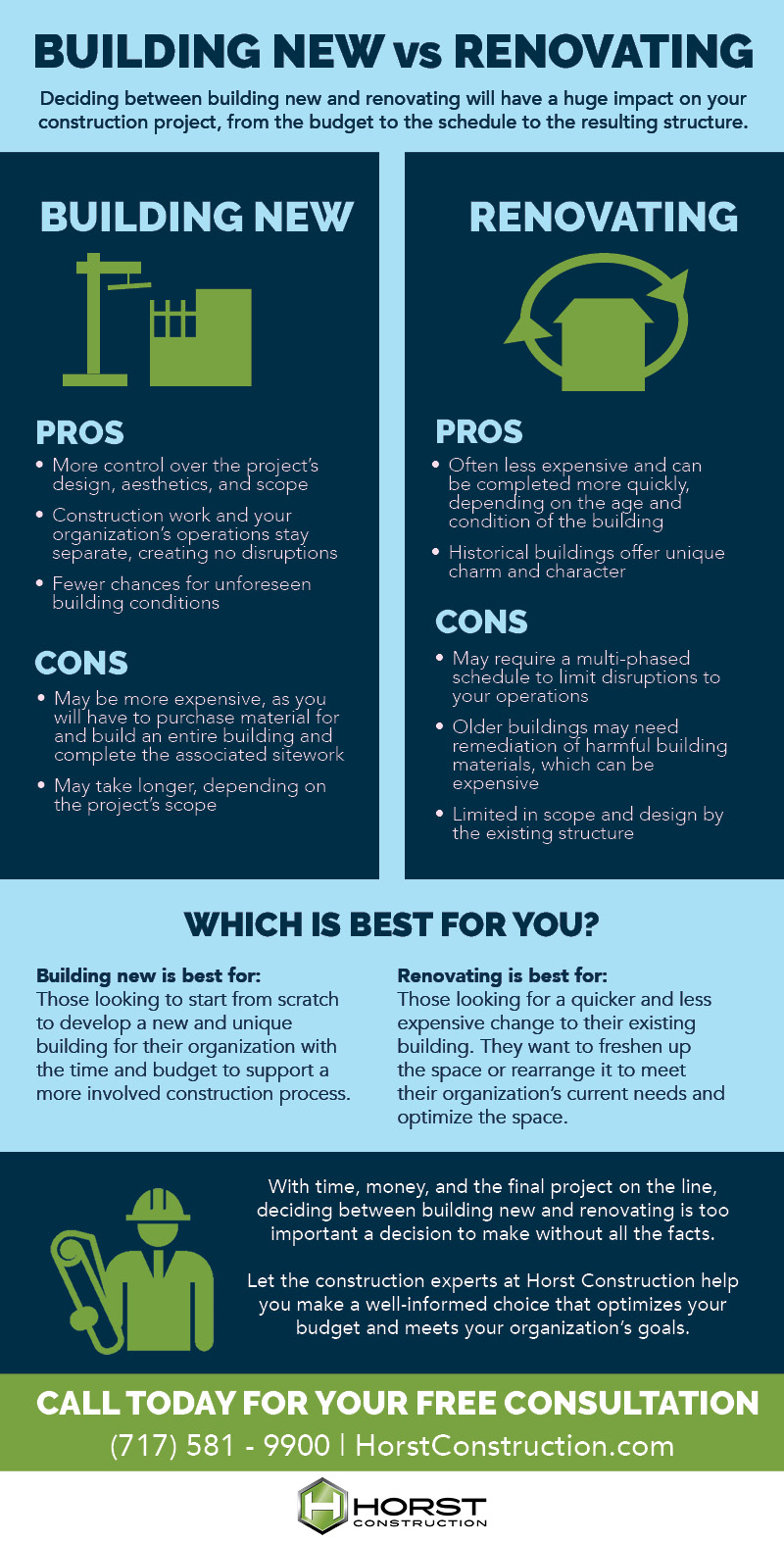

Do not allow your upgrade come with any of these downsides: Are you planning on offering this home in the close to future? When taking into consideration renovations, keep in mind that the overall expense will possibly entail more than just labor and materials.